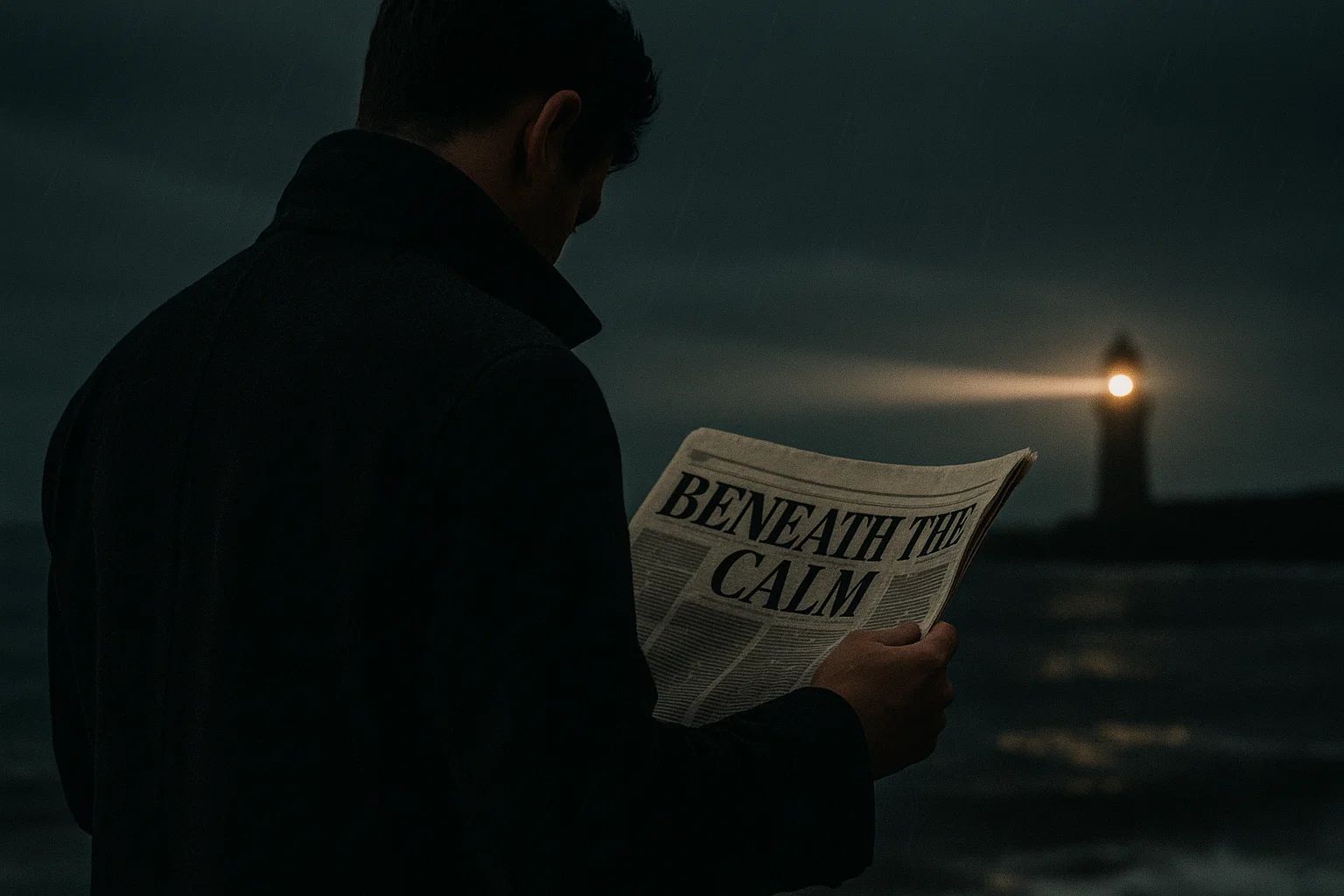

On the surface, America’s financial system seems steady. Markets open on time, bank apps work, and the headlines are more political than economic. Yet below that calm, pressures are building. Branches are closing, debts are climbing, jobs are thinning out, and markets swing with a frequency that once signaled emergencies.

History shows how cracks ignored can swell into something bigger. In 2008, the banking system looked orderly—until it wasn’t. In 2020, markets snapped from record highs to sudden freefall. What’s different today is that the risks don’t arrive in front-page drama. They build quietly, leaving those who depend on savings and retirement accounts more exposed than they realize.

The Vanishing Local Bank

Drive through almost any town and the signs are fewer. More than 320 branches have closed this year, with JPMorgan, Wells Fargo, and Bank of America among those pulling back. Community banks, long the anchor of small towns, are disappearing too.

For many households, that means more than inconvenience. Local branches were once safety valves when national systems buckled. In 2008, those with strong ties to community banks often had better access to credit and support. That cushion is eroding, just as dependence on digital infrastructure deepens.

Debt That Redefines “Safe”

The U.S. now carries over $37 trillion in federal debt. Interest payments alone have doubled since 2022, overtaking defense spending as a line item in the federal budget.

That matters because Treasuries—the cornerstone of many retirement portfolios—depend entirely on Washington’s credibility. If confidence in repayment even wavers, bonds once assumed unshakable could come under stress. For investors seeking safety in government paper, this is a blind spot too important to ignore.

Main Street Strains

Beyond Wall Street, Main Street is thinning out. Since spring, more than 76,000 retail jobs have disappeared. Restaurants are scaling back staff. For those in their 50s and 60s, this isn’t just data—it’s lived experience: layoffs, reduced hours, and early retirements.

Because consumer spending drives so much of corporate America, the pain flows back into markets. Institutional managers are already trimming exposure to consumer-sensitive sectors. But most 401(k) and IRA portfolios remain concentrated there, tethered to a cycle of spending that’s showing strain.

Markets That Don’t Sleep

Daily one-percent swings in the S&P 500 no longer raise alarms. Volatility has become routine. For those drawing from retirement savings, this is more than noise. Withdrawing in down markets risks locking in losses permanently. The old 4% rule of thumb for withdrawals was designed for calmer waters—it may already be outdated.

Diversification That Isn’t

Most investors assume their portfolios are diversified. Yet peel back the layers, and exposure often comes down to the same forces: mega-cap tech stocks, government debt, and the health of the consumer.

Institutions define diversification differently. They hold private credit, real assets, and structured strategies built to absorb shocks. Most individuals don’t realize these options exist—or assume they’re off-limits.

What Institutions Do Quietly

The reality: there are tools designed to broaden exposure and reduce reliance on the same fragile pillars. Self-directed retirement accounts can, under IRS provisions, include real estate, private credit, and even certain forms of precious metals. These strategies require discipline and oversight, but they illustrate the gap between how institutions prepare—and how individuals are left to hope markets behave.

The Road Ahead

The decision for savers is less about fear, more about awareness. You can assume the surface calm will hold. Or you can recognize that preparation—not prediction—is the difference between weathering the next storm and being caught in it.

The quiet risks are here already. The question is whether you’re willing to see them.

Independent Thinking. Steady direction.