Imagine throwing a stone into a still pond. The initial splash is loud and clear, but soon it’s the waves—those ripples moving outward—that carry the story forward, echoing long after the stone has settled. Financial crises are much the same. Their shocks may arrive in a sudden boom or bust, but their echoes can last decades. The way money bends, markets react, and policies form today all carry traces of past upheavals.

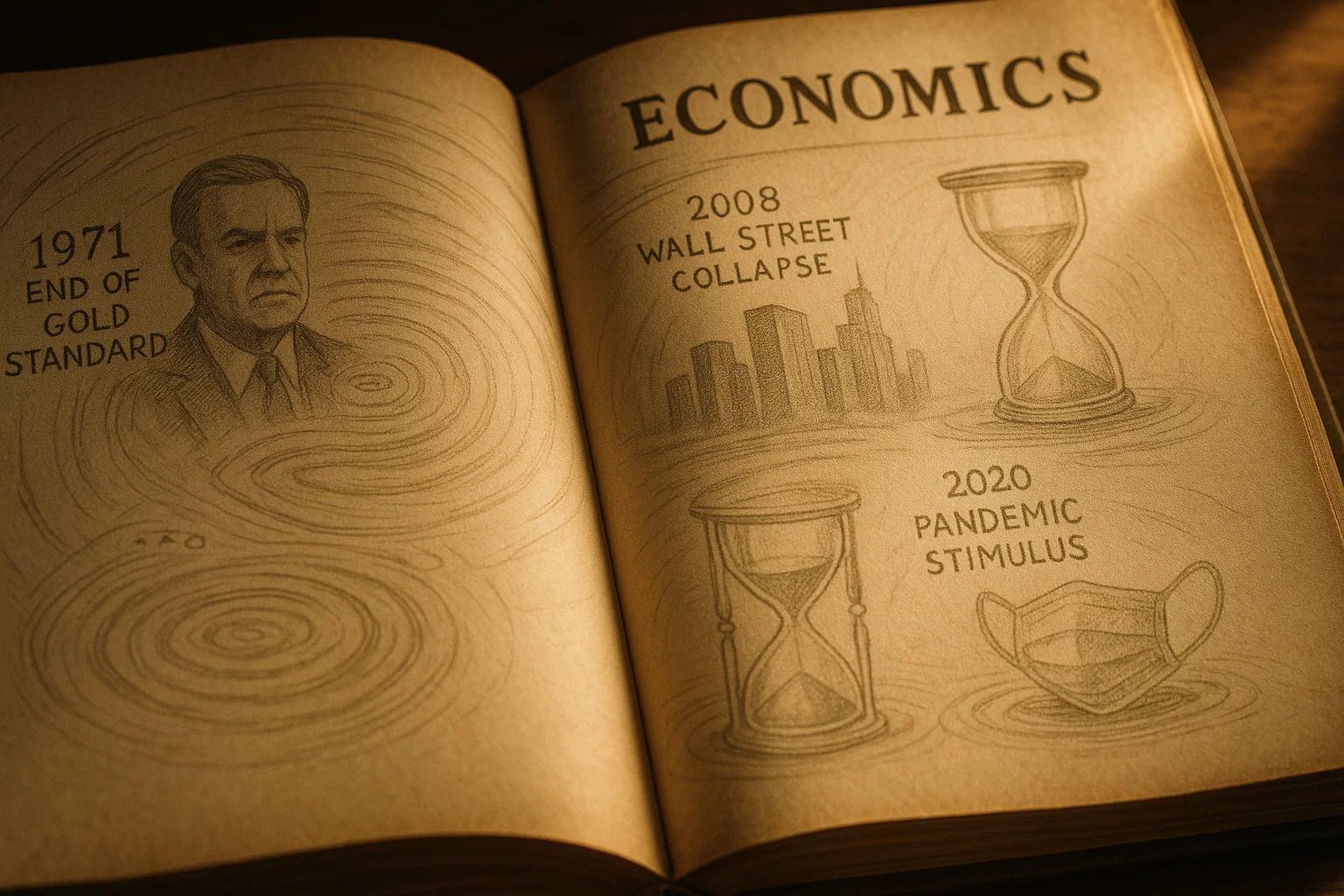

In 2025, the echoes of crises spanning from President Nixon’s 1971 economic shock, to the 2008 global financial crisis, to the unprecedented 2020 pandemic stimulus, continue to shape the financial landscape. These events recalibrated trust, reset expectations, and rewrote the rules on how governments, markets, and savers interact. This editorial takes a reflective walk through those seismic moments to understand how their long shadows still influence money today.

1971: Nixon and the End of Gold

August 15, 1971, marked one of the most pivotal turns in modern economic history. President Richard Nixon stunned the world by ending the dollar’s convertibility to gold—a move that broke the Bretton Woods system and effectively ended the gold standard. Nixon’s decision, later famously framed by Treasury Secretary John Connally as “the dollar is our currency, but it’s your problem,” was a defensive move to protect dwindling U.S. gold reserves amid rising trade deficits and global demands for gold redemption.

This moment shifted money from something tangible, anchored by gold, to a fiat system, governed by policy and faith rather than gold ounces. The immediate effects were tremors: inflation surged, wage-price controls were temporarily imposed, and the U.S. entered a period of “stagflation”—a toxic mix of stagnant growth and rising prices that haunted the decade.

Economist Zachary Loft recently summarized the legacy, explaining that while asset holders and large financial institutions benefited, ordinary Americans faced eroding purchasing power and rising inequality as wages stagnated despite higher nominal paychecks. Inflation, once restrained by gold’s discipline, became a structural challenge with ripple effects on housing, debt, and wealth distribution that endure today.

Nixon’s Shock revealed the danger in unilateral economic policy moves without global coordination. The aftermath discarded fixed exchange rates for floating currencies, introducing new volatility but also flexibility.

As Nobel laureate economist Paul Krugman recently noted in a tweet

“The end of Bretton Woods set loose the forces of market-driven currency shifts—both opportunity and risk for two generations.”

The echoes of that choice remain audible in every central banker’s policy debate today.

For those wanting a deep dive into this historic moment, Nixon’s 1971 televised address remains a fascinating watch. The official archival footage offers rare insight into the administration’s mindset and the era’s economic challenges.

2008: When Crisis Reshaped Trust

Fast forward to September 2008. The collapse of Lehman Brothers sent shockwaves through the global financial system unlike any since the Great Depression. Fueled by risky mortgage lending and opaque derivatives, the crisis clawed back close to $19 trillion in household wealth, doubled unemployment, and shattered confidence in American financial giants and the dollar itself.

Yet paradoxically, during the crisis, the U.S. dollar rallied sharply as markets sought safety. This was a flight to the “reserve currency of last resort” amid global panic. A 2009 ECB working paper explained that negative shocks to the U.S. economy triggered a surprising strengthening of the dollar because international investors repatriated capital, trusting the U.S. was a safe haven despite the turmoil.

The crisis also shattered trust in financial institutions and conventional economic wisdom. It forced massive government bailouts, radical monetary easing, and new regulatory frameworks. The scars remain in today’s investor psyche: caution on leverage, skepticism about “too big to fail,” and heightened awareness of systemic risks.

Market strategist Paul Hickey tweeted shortly after the crisis: “2008 changed everything. It reminded us all how fragile markets are and how intertwined global finance has become. Trust is the currency that cracked before anything else.” The profound uncertainty led to years of slow recovery, policy innovation, and renewed debate about the dollar’s future role.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

2020: A Pandemic’s Lasting Shadow

The sudden arrival of COVID-19 in early 2020 dealt an unparalleled economic shock. Unlike the drawn-out crises before it, this one came with historic swiftness—a global shutdown of commerce, travel, and daily life. The government’s response was unprecedented stimulus: trillions pumped into the economy through direct payments, small business aid, and enhanced unemployment benefits to prevent a deeper recession.

This fiscal action fostered a rapid rebound but also sowed seeds of new challenges. Several economists now contend that while the stimulus averted the worst, it also contributed to inflationary pressures as demand outpaced supply in key sectors. The dynamics of that inflation are still playing out in 2025.

An ECB report notes that fiscal support measures remain “broadly expansionary” years after the initial crisis, contributing to growth but also complicating inflation management and debt sustainability. Similarly, Brookings Institution analysts observe that the “jury is still out” on the full inflationary impact of the pandemic stimulus, with fierce debate ongoing among economists.

Reflective commentary from policy experts underscores the tightrope walk governments face between supporting recovery and avoiding overheating the economy. The pandemic’s economic aftermath revealed how policy decisions resonate beyond immediate relief, shaping inflation, debt levels, and trust in governance.

For those who want to understand how the pandemic stimulus influences today’s economy, several recent YouTube analyses provide clear explanations of the tradeoffs and legacy effects of these fiscal policies.

The Echoes We Hear in 2025

Today, in 2025, we live amid the long echoes of those seismic events. The Nixon Shock taught us how quickly policy shifts unmoored by global coordination can reshape trust in money itself. The 2008 crisis showed us the fragile scaffolding on which financial systems rest and the essential role of trust in the dollar and institutions. The 2020 pandemic stimulus revealed how extraordinary government intervention can keep the economy afloat but also leave lasting challenges, including inflation and debt dilemmas.

Inflation remains a central concern. The shift away from gold decades ago left monetary policy as the primary tool to manage price stability. The crises since have exposed the complex tradeoffs between growth, inflation, and financial stability. Central bankers today walk a narrow path, balancing lessons from past inflationary waves against the need to support modern economies.

Similarly, trust continues as an underlying theme—from trust in the U.S. dollar’s reliability as the world’s reserve currency to trust in the institutions that manage monetary and fiscal policy. Each crisis chipped away at that trust but also reinforced its importance.

Economist Mohamed El-Erian recently tweeted

“History’s lessons on crises remind us that markets are shaped as much by psychology and trust as by numbers. Navigating volatility requires more than models — it demands wisdom from the past.”

Lessons That Still Guide Us

The biggest lesson from these historic crises is that history does not repeat perfectly, but it resonates in cycles and echoes—nudging markets and policymakers to respect certain fundamentals:

Trust matters: No financial system can thrive without it, whether trust in currency convertibility, institutions, or policy frameworks.

Policy flexibility is vital, but unilateralism carries risks: The Nixon Shock’s abrupt move without global coordination caused unforeseen instability.

Crises reveal systemic vulnerabilities: 2008 showed how interconnected risks spread, demanding new oversight and caution on leverage.

Stimulus is a double-edged sword: The 2020 response showed its power to stabilize but also its possible inflationary and debt consequences.

History teaches patience and humility: Markets will always face uncertainty, and long-term resilience depends on learning from—not ignoring—the echoes of past shocks.

These lessons are not mere academic reminders. For everyday investors and savers, they underline why portfolio diversification, understanding inflation risks, and watching policy signals remain essential strategies.

The Compass Ahead

As we move through 2025, the echoes of past crises don’t give us a map with clear directions — but they do offer a compass. They remind us that policy choices, market shifts, and even moments of panic leave marks that last far longer than the headlines.

For investors and savers, the lesson is not alarm but perspective. The turbulence of 1971, 2008, and 2020 reshaped the financial waters we sail in today. Knowing their echoes helps us read the current more clearly.

For those who want to dig deeper, here are a few worthwhile stops along the way:

Nixon’s 1971 address announcing the end of the gold standard [YouTube link]

A concise explainer of the 2008 financial crisis [YouTube link]

Recent analysis of the pandemic stimulus and its legacy [YouTube link]

History’s echoes may never fade, but they can steady our hand on the wheel — and help us keep our course in uncertain seas.

Independent Thinking. Steady direction.