If you're chasing Nvidia, Amazon, or Palantir right now, I've got one word for you:

Stop.

Because according to legendary investor Whitney Tilson, AI mania is about to leave millions of investors holding the bag.

"The AI boom is real... but the next wave of gains won't come from where everyone expects."

Instead, he believes a stealthy, little-known stock is about to blow past Nvidia in a way few investors see coming.

And here's the craziest part...

He didn't find this stock by digging through balance sheets or chasing headlines.

He found it using a stock grading system that he and his team quietly spent years developing behind the scenes.

It's the same system that just flagged this unusual AI stock with a 94 out of 100 rating... one of the highest scores ever recorded.

And right now, for the first time ever, Whitney's giving away:

The name and ticker of this company

His full analysis

And a demo of the system that uncovered it

All completely free.

Partner Spotlight

If you walk into a casino in Las Vegas and look at the roulette table, you will see a screen showing the last 10 numbers. Red, Red, Red, Black, Red... The casino puts that screen there for a reason. They know that the human brain is wired to find patterns where none exist. Gamblers look at the screen and think, "It's been Red 5 times, so Black is due!" or "Red is hot, I'm betting Red!"

The casino makes billions of dollars because humans bet on stories and feelings. The casino, however, never bets. The casino operates on math. They know the statistical probability of every spin. They don't care about "luck." They care about the edge.

In 2025, the Stock Market has become a Casino. And right now, millions of retail investors are behaving exactly like the tourists at the roulette wheel. They are staring at one "Hot Number"—Nvidia (NVDA)—and betting everything on it, simply because it has been winning.

But independent thinkers know that in the market, just like in Vegas, the "House" always wins eventually. And today, the "House" is represented by the Quantitative Investors (Quants) who are quietly selling the hype and buying the math.

The "Law of Large Numbers" Trap

To understand why the smart money is rotating, you don't need a crystal ball. You just need a calculator. Nvidia is currently valued at over $3 Trillion. According to recent analysis, for Nvidia to deliver just a 10% annual return over the next 7 years, it would need to generate $293 Billion in annual earnings by 2032.

To put that in perspective: That is more profit than Microsoft and Alphabet combined generate today. It is mathematically exhausting for a company the size of a nation-state to keep doubling. The "Story" is great. The "Math" is terrifying.

The "Moneyball" Approach to AI

So, if the "Easy Money" in the mega-caps is gone, where does the smart money go? It rotates into the "Moonshots"—smaller, overlooked companies that are building the actual infrastructure of the future.

This brings us to the concept of "Moneyball" Investing. Just like the Oakland A's baseball team used statistics to find undervalued players that other teams ignored, "Quant" investors use grading systems to find undervalued stocks.

They strip away the emotion. They don't care if the CEO is charismatic. They don't care if the ticker is trending on Reddit. They look at the "Engine," not the "Paint Job."

The Anatomy of a "Perfect Score"

When a systemic investor grades a stock, they look for a specific "cluster" of data points that signal a future breakout. This is what separates a 94/100 stock from a 50/100 stock.

What does that anomaly look like?

Earnings Surprise: The company is consistently making more money than Wall Street expects.

Cash Flow Yield: The company is generating actual cash, not just "adjusted" paper profits.

Value Dislocation: The stock is priced significantly lower than its historical growth rate.

This is the exact methodology behind the grading system mentioned in today's opening message. It ignores the "Narrative" (Nvidia is cool!) and focuses purely on the "Probability" (Where is the mispriced value?).

The Compass Ahead

History shows that in the late stages of a bull market, the crowd chases the "Winners of Yesterday" (Cisco in 2000, Nifty Fifty in 1970). The Independent Trader chases the "Winners of Tomorrow."

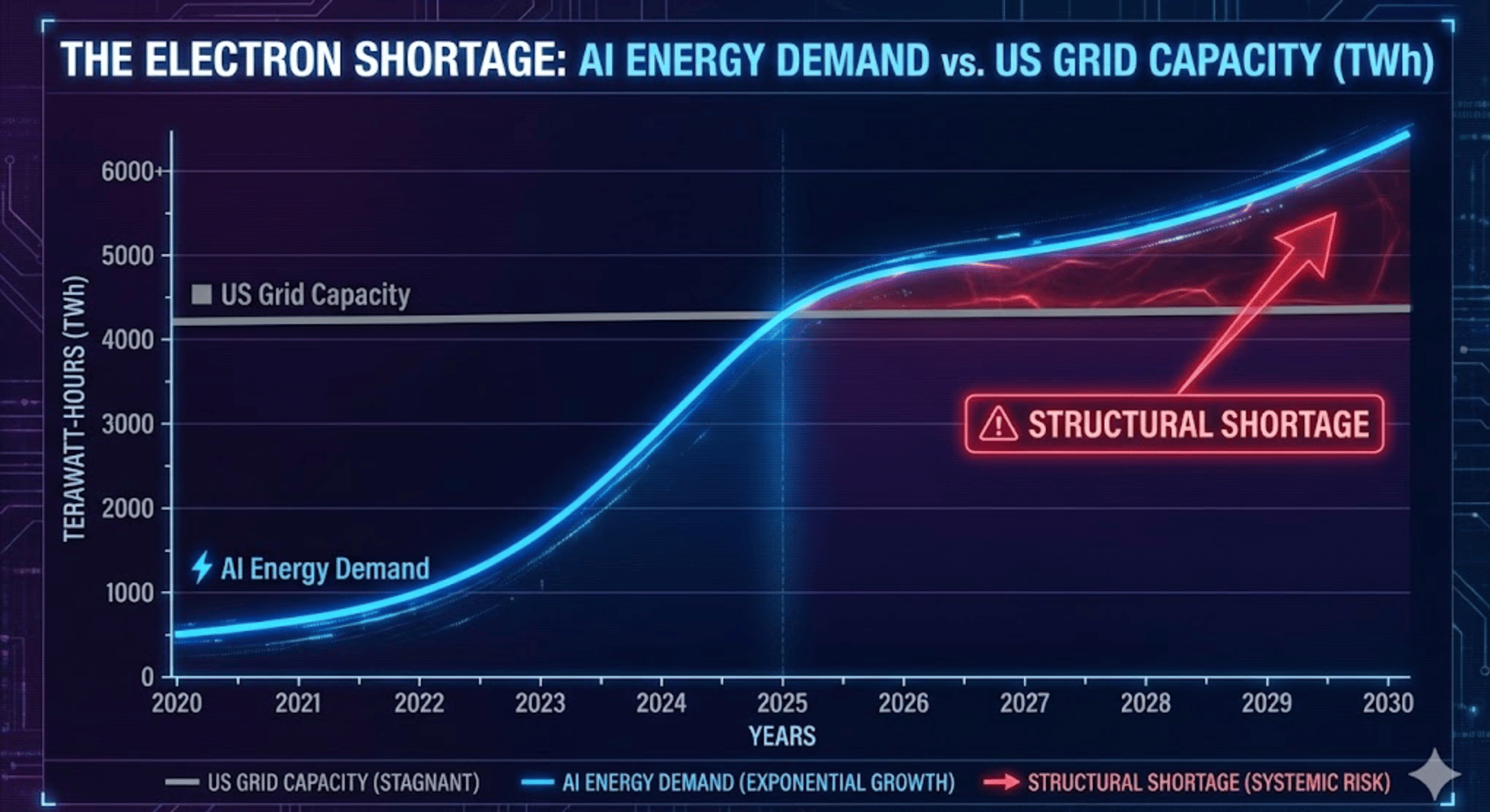

The next phase of the AI boom won't be about who makes the chips. It will be about who powers them, who cools them, and who builds the infrastructure. And to find those winners, you need to stop guessing and start scoring.

Stay independent.