NVIDIA's last great chip minted a new class of millionaires.

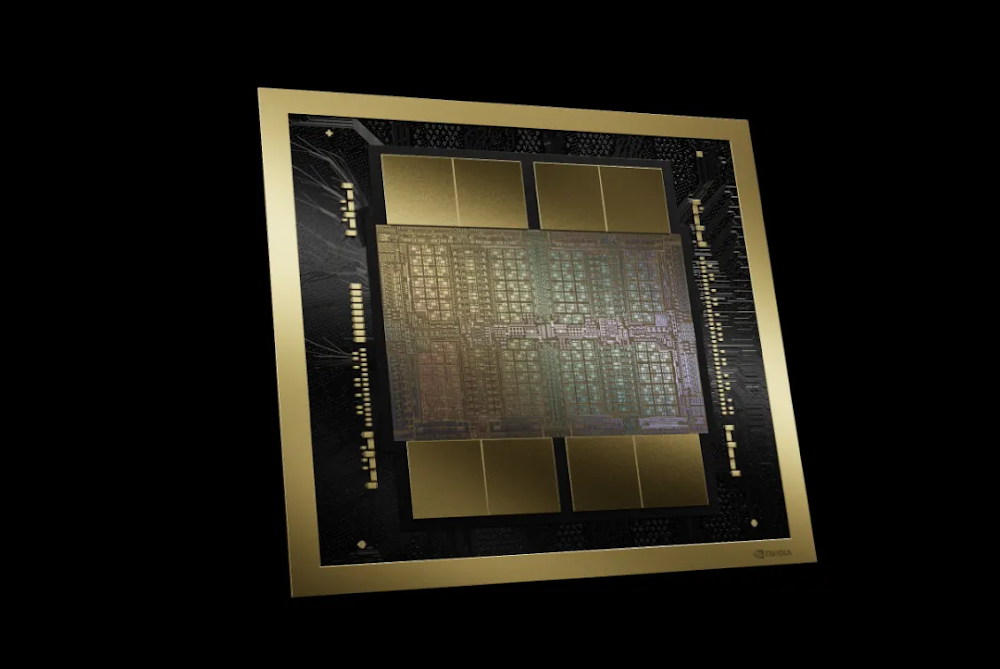

But their new Superchip, THOR, is 20X more powerful.

And the company holding the keys?

A tiny supplier with 6,800+ patents locked up - patents every major tech firm must license… Apple, Google, Amazon, even NVIDIA itself.

NVIDIA tried to buy them. The FTC said no.

And now, billionaires are piling in before the November 19th announcement puts this stock on every front page.

The last time NVIDIA's suppliers got this kind of spotlight, they delivered gains like:

164% in a single day

416% in 60 days

2,815% in under 2 years

Will you be in before November 19th?

Partner Content

The Map Behind the Machines

Every boom has its stage stars. Chips get the spotlight.

But power often sits a step higher — with firms that own the rules everyone else has to play by.

These are the people who design the standards, hold the licenses, and decide how fast the industry can move.

They don’t shout. They set the terms.

Quiet Rules, Real Leverage

We’ve seen what happens when one giant tries to pull a key technology entirely in-house: regulators step in.

That kept the “tollbooth” model in place — the industry keeps building, but it pays the owners of essential designs along the way.

Factories and timelines can slip. Royalty checks don’t.

That’s real leverage in a noisy market.

The Positions That Never Lose

The smart money doesn’t chase launch events. It studies where others must ask permission.

Who controls the key interfaces? Who owns packaging know-how? Who writes the standards others must license to keep shipping?

Those positions tend to look “boring” — until the next wave depends on them.

When that happens, steady, repeatable cash flow starts to matter more than splashy promises.

The Compass Ahead

The next leg isn’t about who can talk fastest.

It’s about who the rest cannot build without.

If you want exposure with less theatre and more control, follow the places where access is rented, not owned.

That’s where real power lives — and where wealth doesn’t need to shout.