NVIDIA's revolutionary new invention just solved the #1 chokepoint that's been strangling big AI companies.

And Tech legend Jeff Brown — the Silicon Valley insider who called NVIDIA before it skyrocketed more than 30,000%...

... says a shocking announcement by NVIDIA CEO Jensen Huang could make a lot of early investors rich.

Partner Spotlight

For the past year, Nvidia has been the closest thing the market has had to a gravitational force. Every quarter rewrote the last one. Every guidance hike pulled expectations higher. And every upgrade, every blog post, every chart seemed to confirm the same message:

AI is here — and Nvidia owns the map.

But here’s the thing the headlines rarely mention.

When a company becomes the center of a new technological era, the real story isn’t what happens to the giant.

It’s what happens around it.

Right now, Nvidia is moving so fast, growing so violently, and pulling so much demand into its orbit that the pressure building behind it is starting to reshape the entire industry. And if history is any guide, the biggest gains of the next cycle won’t come from the leader everyone already owns.

They’ll come from the companies enabling that leader to expand at all.

That’s the part most investors are missing.

Inside the Forces Pulling the Market Forward

Nvidia is no longer a semiconductor company.

It’s a global buildout, an industrial machine, and an economic bellwether rolled into one.

Its numbers tell the same story:

Annual revenue near $57 billion, with guidance pushing even higher.

A market cap flirting with $5 trillion.

Customer demand for GPUs measured not in thousands, but in millions.

Meta alone planning for 1.3 million H100-class chips.

AI hasn’t slowed down.

It’s accelerating.

But acceleration has a cost — and not in the way most investors think.

You can’t build AI with enthusiasm.

You build it with:

memory capacity,

advanced packaging throughput,

optical bandwidth,

cooling infrastructure,

and power — a lot of power.

And that’s where cracks are starting to show.

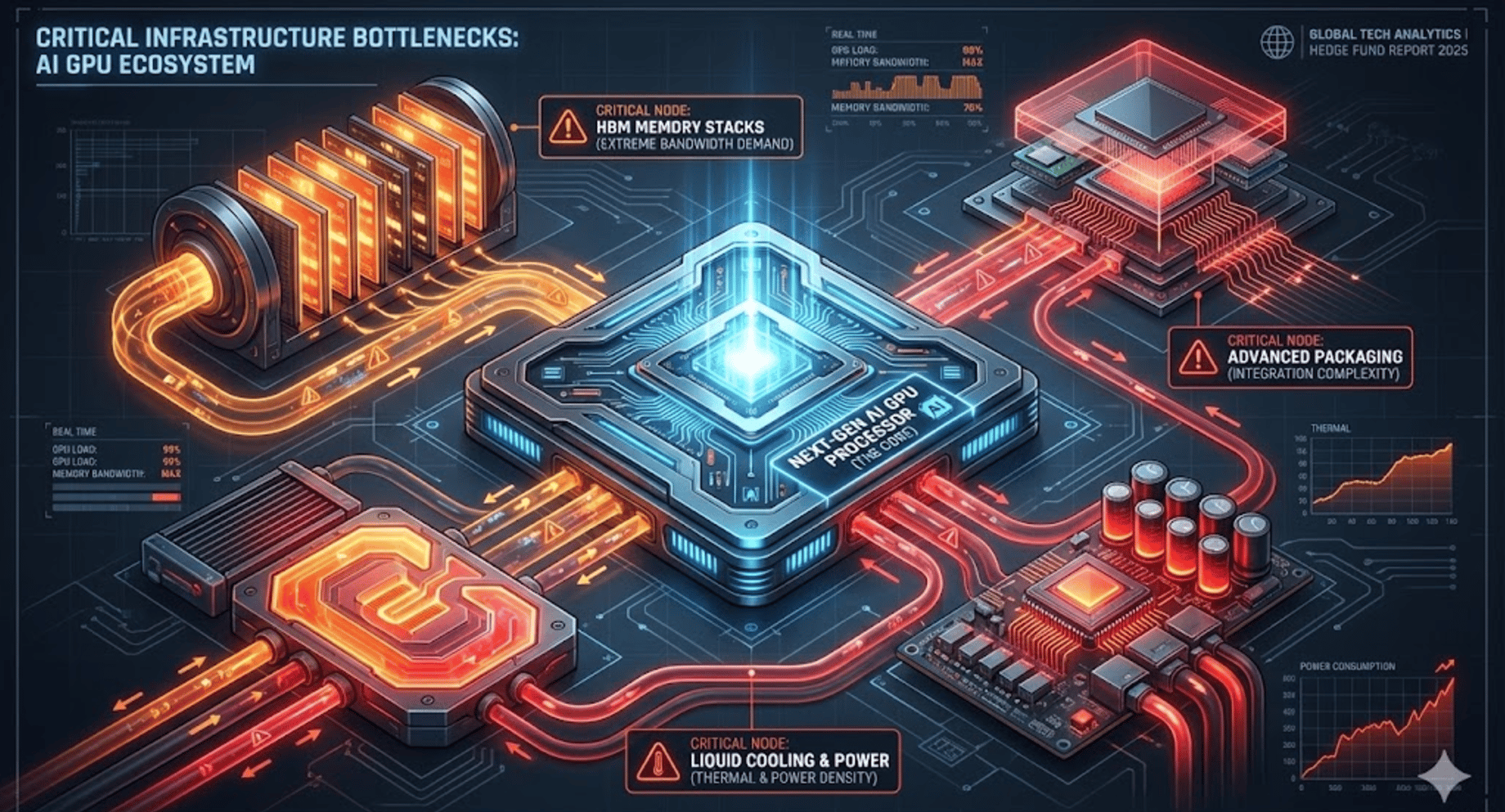

The Problem Even Nvidia Can’t Outrun

Nvidia can design every generation of chips.

It can sell out months in advance.

It can raise prices and still see backlogs.

But it cannot solve the physical limitations of the world overnight.

HBM shortages

SK Hynix, Samsung, and Micron cannot produce enough high-bandwidth memory to meet 2026 demand estimates. AI systems choke without it.

Packaging bottlenecks

CoWoS capacity remains tight globally. TSMC, Intel, and ASE are racing to expand, but timelines stretch years, not months.

Cooling and energy strain

Data center power demand is rising so quickly that utilities from Virginia to Oregon are delaying new AI campuses. Even the best GPUs are useless without voltage, cooling, and space.

These aren’t minor hurdles.

They’re the guardrails defining the next decade of AI.

And that’s why the most interesting story for 2026 isn’t whether Nvidia hits another record.

It’s who benefits from the strain Nvidia creates.

Where the Disciplined Investors Are Moving First

Over the past several months, hedge funds, long-only institutions, and sovereign capital have started quietly adjusting their exposure. Not a “sell everything” move — just a careful rotation.

What they’re doing:

trimming mega-cap AI after historic gains,

building positions in smaller names tied directly to AI infrastructure,

buying the companies that expand memory, packaging, cooling, and power capacity,

and adding exposure to the suppliers Nvidia itself depends on.

Call it the “second wave.”

If the last 18 months belonged to silicon,

the next 18 may belong to the ecosystem around it.

The Firms Holding the Real Keys to AI Expansion

When Nvidia doubles, its suppliers don’t just celebrate — they scale. And scaling means margin expansion, new orders, and valuation re-ratings that can trigger the kind of moves you only see early in a cycle.

This is where the next leadership class is forming:

Memory Providers

SK Hynix, Samsung, Micron — without HBM, AI clusters don’t function. These companies are seeing unprecedented demand visibility.

Advanced Packaging

The world needs exponentially more CoWoS capacity. Only a few firms can provide it.

Optical Interconnect & Networking

GPUs can only go as fast as the light connecting them. A small group of suppliers sits in the middle of that transition.

Cooling & Power Systems

AI heat density is breaking old assumptions. New cooling tech, new grid partnerships, and new on-site power models are emerging.

Semicap

Equipment names feeding the buildout stand to benefit for years.

Energy Providers

Google, Amazon, and Microsoft have already begun tapping nuclear assets to anchor their AI campuses. This is the first year energy became an AI investment theme — and it won’t be the last.

Add it up, and you get a picture few investors are seeing clearly:

The fastest gains rarely come from the giant.

They come from the pressure the giant creates.

Which brings us back to today’s promo.

Jeff Brown isn’t pointing to Nvidia.

He’s pointing to the companies Nvidia needs.

And historically, that’s where the asymmetric returns live.

The Compass Ahead

Nvidia will keep dominating headlines.

It may keep breaking records.

And it will likely remain the backbone of the AI era for years.

But markets don’t reward what’s obvious.

They reward what’s inevitable but overlooked.

Right now, that’s the circle of companies solving Nvidia’s biggest challenges — the firms unlocking the next phase of the AI buildout.

The “household names” phase is ending.

The “infrastructure acceleration” phase is beginning.

And as always:

Stay independent.